NEVI DC Fast Charging Station Total Project Cost Averages $915,000

There are three keys to profitability for DCFC charge-point operators: deployment costs, operating and maintenance costs, and charging and add-on/amenity revenue. The lower your upfront and operations costs, combined with growing utilization and revenue, the quicker the time to breakeven and profitability for a fast charging station operator.

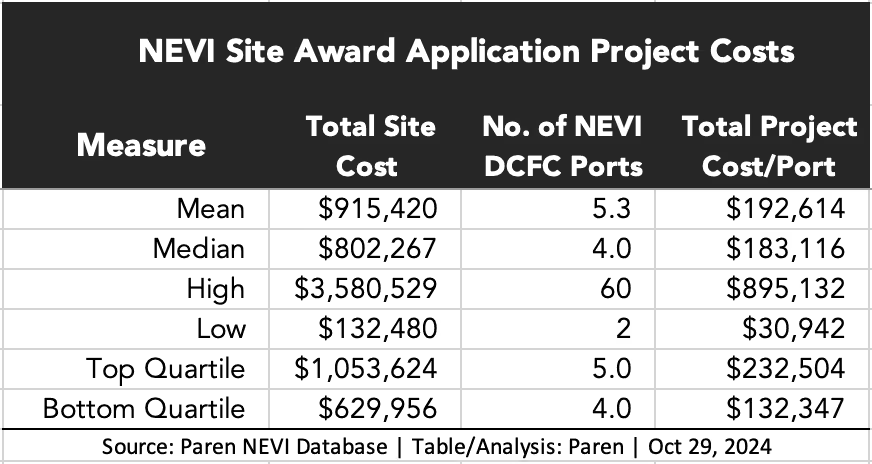

The biggest challenge and financial hurdle for charge-point operators (CPOs) to overcome on the path to DCFC station profitability is the significant upfront deployment costs. In fact, based on Paren's analysis of 330 winning National Electric Vehicles Infrastructure (NEVI) site awards, the average total NEVI project cost is $915,420. The median total cost is $802,267 and the top quartile (the lowest 75% of data is below this point) is $1,053,624.

DC fast charger deployment project costs have many variables, including construction and engineering, amenities such as canopies and pull-through lanes, and the hardware chosen. In this analysis, we partially normalized the project costs by calculating the Total Project Cost Per Port. This provides a more meaningful benchmark since many NEVI sites have 5, 6, 7, 8, or more ports — not just the minimum required four ports. The mean project cost per port is $192,614 and the median is $183,116.

The highest NEVI project cost to date is nearly $3.6 million for a 4-port site in Hawaii that includes battery storage, with the lowest site cost at a Kwik Stop store in Wisconsin, for $132,480. The Sustainable Partners/Aloha Charge Honolulu site was also the highest per port cost at $895,132, while a Tesla Wisconsin site has the lowest project costs per port at $30,942.

Notes: 1) The costs in the above table are the total project costs, NOT the funding amount applicants will receive. 2) The measures in the Ports and Cost/Port project are based on just those columns, and are not calculated from the Total Site Cost.

Interested in detailed data and analysis on state NEVI programs and winning applicants? Request a demo of our online NEVI database.

Going forward, expect to see trends that lead to both an increase and decrease in deployment costs. On the decreasing cost side, companies including Tesla, EVgo, and others are using pre-fabricated charger installations. EVgo states that these pre-built platforms can reduce station construction costs by 15 percent.

EVgo is using a prefabrication approach to new station installation that is anticipated to cut average station installation time in half and save an average of 15% in station construction costs at eligible sites. With a scalable design that starts at six fast charging stalls—supporting EVgo’s focus on expanding stall counts to bolster resiliency—the prefabrication model further standardizes EVgo’s construction process and station layout by utilizing a modular skid.

Hardware costs are a mixed bag, with increasing competition among dozens of hardware manufacturers — including new entrants to the US market from Europe, South Korea, China, and Taiwan — leading to lower per-unit costs in some cases. However, higher costs are being driven by demands for better quality and reliability, which requires higher-quality materials and electronics, along with the addition of NACS cables and connectors, higher-power units at 350-400 kW and higher, improved cable management, larger interactive digital display screens, Plug-N-Charge integration, multiple payment options, and extended warranties and service-level agreements .

Furthermore, the sites themselves are evolving from setups like four 150 kW chargers located in the back corner of a shopping mall parking lot to 12 to 40 350/400 kW charging units with pull-through lanes, canopies, and other amenities. In some cases, fast charging sites are being built as greenfield charging hubs or plazas, often referred to in Europe as “forecourts.”

One example is the newly-opened charging plaza with 40 DCFC charging stalls from the start-up company Rove. Roughly 100 charging stations in the US now have 20 or more ports, but what makes the Rove station special and more costly, is that it includes a Gelson’s ReCharge store, overnight security, on-site staff, secure indoor workspace, bathrooms, and Wi-Fi.

As the public fast charging ecosystem matures, with venture-backed startups to large companies such as Mercedes-Benz, Walmart, IONNA, and others entering the market — expect more dedicated charging hubs designed to improve the customer experience, with more chargers, additional amenities including stores, food service, and canopies to become the norm. And with it, the average cost of these sites may often be near or exceed $2 million, double the current average.

By Loren McDonald, Chief Analyst